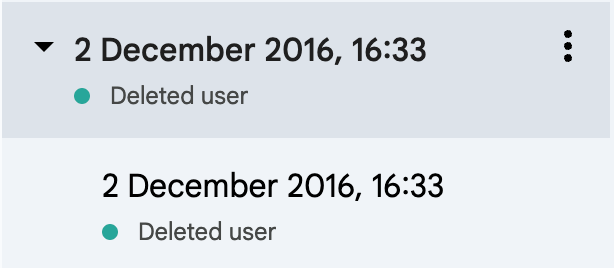

On this day: 2nd December 2016 @ 4:33pm

8 years ago, I started pitching Usable Balance.

This date is special, because it highlights how long I’ve spent validating the concept of Usable Balance. It’s the date the first concept deck was put together in Google Slides (see screenshot of version history)

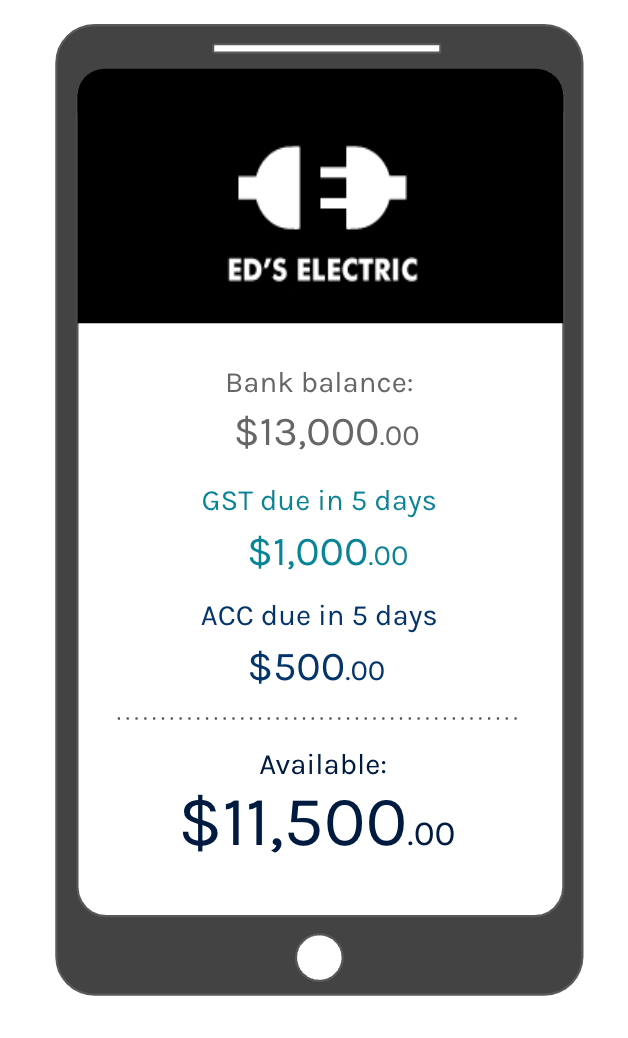

The concept was simple, show what a business owner has in their bank account minus what they owe to IRD and when. Sounds familiar? It’s because fundamentally it hasn’t changed, nor has the pain to the business owner.

Back then, it was known as Simple Balance.

But before this date, there is some context needed.

In October 2016, my mum passed who was my biggest supporter in all the (ad)ventures I chose to follow - no matter how crazy it was. As a solo mum, even when working multiple jobs, she always had time for me. Gosh I miss her.

In November 2016, I had received the news that Penny was to shutdown unexpectedly. Penny was the P2P lending company I was CTO for, and unknown to me, they were struggling and could not raise the required $20M capital to please the FMA concerns around being able to sustain any losses when launching. It was dead in the water, leaving me without a job coming into the Christmas period.

In my infinite wisdom, I thought the best thing to do was try launch a new company, and off the back of Penny - which I was passionate about building money literacy through P2P lending (turning borrowers into lenders), this seemed to make sense.

Reality is, I wasn’t ready for it. I tried pitching to Westpac, to a good friend Lewis Billinghurst. It needed refinement, my pitch deck was weak. It needed much, much more validation and modelling to even get a bank to consider it.

I didn’t have it in me.

Mentally exhausted, physically weak, I needed a break. I took a December and January off just to be with family, reset, find a stable job and put this on the back burner for now.

End of January 2017, I joined ACC to lead their flagship project. The goal was to bring people online into a digital experience, away from paper and letters and get instant access to the support they needed. My time there was a huge success, I thrived in quasi government/public sector, and got involved in the business side of ACC too.

And that’s when I saw the stars align, ACC has a struggle with business owners knowing what they owe and when. I’m inside the business/customer, I can identify the key individuals needed for this to happen, this is the chance…

… or not. As I positioned, got the right people together, I then got approached for an executive role in Government. I had to focus on this new role, it was the second role in government, first time executive in public sector and it started off with their Legal Counsel risk assessing my character to ensure they hadn’t made a mistake bringing me on board to lead Data Ventures.

I will end this part of the story with a link to the IP we released to the public domain at Data Ventures when assessing opportunities to invest in and launch. It’s a key part for the next part of the story.